As-Salaam Zakat Calculator

Pay Your Zakat. Change Lives

What is Zakat?

100% Donation policy

Zakat is one of the Five Pillars of Islam, and it’s all about giving back. Every year, Muslims are encouraged to give 2.5% of their savings and eligible assets to those in need. It’s not just a financial obligation – it’s a way to purify your wealth, help those less fortunate, and bring blessings into your life.

Zakat can be given on savings, investments, gold, and more. By paying Zakat, you help create a more equal and compassionate world, making a real difference to those who need it most.

How to Calculate Zakat

Use our Zakat CalculatorWork out what you own

List all your assets, including cash, savings, gold, investments, and business stock—everything that counts towards your Zakatable wealth.

Deduct Your Debts

Subtract any short-term debts, outstanding bills, or payments due—Zakat is only payable on what you truly own.

Compare Your Wealth to Nisab

If your net wealth is above the Nisab threshold, Zakat is due—if it’s below, you’re not required to pay this year.

Calculate Your Zakat

Simply give 2.5% of your total eligible wealth—that’s your Zakat amount, ready to be donated!

Use Our Zakat Calculator

Traditionally, Zakat was calculated using simple assets like gold, silver, and cash. Today, with modern finances including stocks, pensions, and cryptocurrency, the calculation has evolved.

Our Zakat Calculator makes it easy by guiding you through each step, ensuring you give the right amount in the simplest way possible.

Current Value of Nisab

The Nisab values shown below are updated using live gold and silver prices.

Gold:

Silver:

*values last updated: October 29, 2025 10:25 pm

Frequently Asked Questions

Zakat can sometimes be a complex topic. Find clear answers on calculating Zakat, what you need to include, and what can be deducted.

Do you pay Zakat on income or savings?

Zakat is not based on your income, but rather the assets you own. If your total wealth, including things like gold, silver, cash, and savings, exceeds a certain threshold (the nisab) and has been in your possession for a full lunar year, you are required to give 2.5% of it as Zakat.

This includes any assets that are considered zakatable, such as business holdings or money lent out. To determine your eligibility and the amount you need to pay, you can use our Zakat calculator.

What is the “Nisab”?

Nisab is the minimum amount of wealth a Muslim must possess before Zakaat becomes obligatory. It ensures that Zakaat is only paid by those who have a sufficient level of wealth.

The Nisab threshold is based on the value of either gold or silver:

Gold Nisab: Equivalent to the value of 87.48 grams of gold.

Silver Nisab: Equivalent to the value of 612.36 grams of silver.

Many scholars recommend using the silver Nisab because it results in more people becoming eligible to give Zakaat, meaning more help reaches those in need. At As-Salaam Humanitarian Foundation, we calculate Nisab using live gold and silver prices to make sure your Zakaat calculation is as accurate and up-to-date as possible.

Should I use the Gold or Silver Nisab value?

While some scholars maintain that the Gold Nisab value should be used, using the Silver Nisab is safer and more beneficial to the poor due to its lower threshold. The general view is that the Silver Nisab should be used, meaning if your wealth is above the Silver Nisab threshold, you must pay Zakat on the total amount of wealth you own.

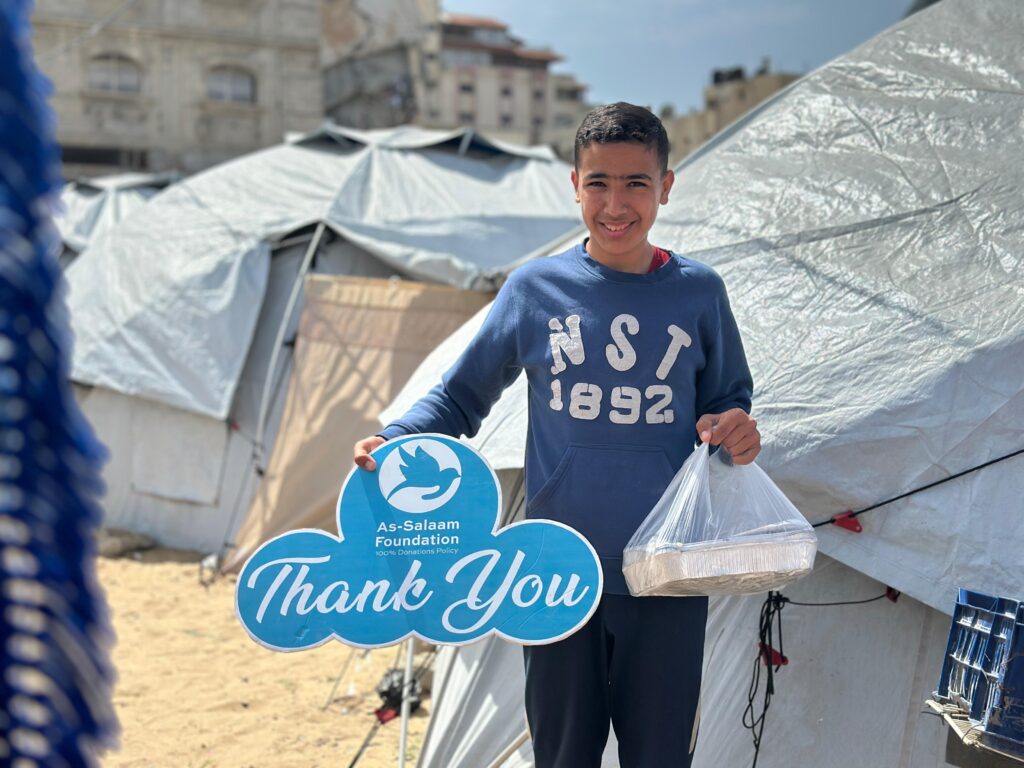

Help Make a Difference with Your Zakat

Make A Difference

Every penny you give goes directly to those in need through our 100% Donation Policy. Trust As-Salaam to deliver your Zakat with transparency, care, and real impact.